Understanding the financial engine powering the decentralized OrbitX ecosystem.

As decentralized finance (DeFi) continues to grow, tokenomics — the economic structure behind a token — plays a vital role in determining a project’s sustainability, fairness, and long-term value. In the case of OrbitX, the $RTX token is not just a currency, but the core of a powerful Web3 ecosystem built on transparency, rewards, and community governance.

In this blog, we’ll break down the token supply, allocation strategy, and how OrbitX plans for the future through smart tokenomics.

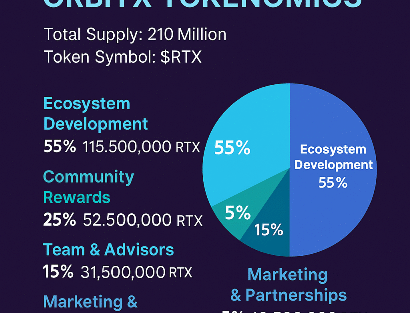

🔢 Total Supply of $RTX: 210 Million Tokens

OrbitX has capped its total token supply at 210,000,000 RTX, ensuring scarcity and long-term value. Unlike inflationary models, this fixed supply supports sustainable growth while enabling fair distribution.

📊 Token Allocation Breakdown

Here’s how the total supply of $RTX is strategically allocated:

| Allocation Category | Percentage | Token Count |

|---|---|---|

| Community & Ecosystem | 55% | 115,500,000 RTX |

| Treasury & DAO Fund | 25% | 52,500,000 RTX |

| Team & Advisors | 15% | 31,500,000 RTX |

| Marketing & Development | 5% | 10,500,000 RTX |

✅ 1. Community & Ecosystem (55%)

This is the largest share, emphasizing OrbitX’s commitment to community-first decentralization. These tokens are used for:

-

Daily staking rewards (up to 1% daily ROI)

-

Referral bonuses and pool distributions

-

Content boosting and creator rewards

-

Platform engagement and loyalty incentives

🏛️ 2. Treasury & DAO Fund (25%)

This fund powers future development, strategic partnerships, and platform sustainability. Managed by DAO governance, holders vote on:

-

Feature upgrades

-

Ecosystem integrations

-

Reward distribution schedules

🧠 3. Team & Advisors (15%)

This allocation supports the core developers, strategists, and advisors who continue to build OrbitX. These tokens are generally time-locked or vested to maintain long-term commitment.

📢 4. Marketing & Development (5%)

Used for global outreach, campaign launches, strategic growth initiatives, and developer support, this pool ensures OrbitX remains visible and relevant in the fast-evolving Web3 space.

🔥 Deflationary Supply: The Burning Mechanism

OrbitX implements a smart burning system to maintain price stability and increase token scarcity over time.

-

3% of every withdrawal is burned

-

Burning continues until 50% of the total supply is removed

-

This reduces circulating supply and supports long-term value growth

💡 Why This Tokenomics Model Works

OrbitX’s tokenomics are built to serve both early adopters and long-term believers. Here’s why the model is effective:

-

Incentivizes participation through staking, referrals, and bonuses

-

Balances growth and sustainability by limiting total supply

-

Builds trust through DAO-managed treasury and community governance

-

Creates deflationary pressure via systematic token burning

-

Supports builders and creators with marketing and development incentives

🌍 Long-Term Vision

OrbitX aims to become the go-to decentralized ecosystem for both crypto users and creators. With tokenomics that reward users, sustain growth, and reduce supply intelligently, OrbitX is not just a token — it’s a financial engine for the future of Web3.

By integrating real use cases, DAO governance, and powerful staking models, OrbitX ensures that $RTX remains valuable, useful, and community-owned.

🚀 Ready to be part of the movement?

Stake. Earn. Govern. Build — with $RTX.

👉 Explore now at www.orbitxfinance.com

👉 Explore now at www.orbitxnetwork.com